Ekonomika

Western Europe: Debt vs GDP

This investigation explores the relationship between various types of debt—government, private, and household—and GDP growth across Western Europe. The aim was to identify correlations, assess economic health, and determine the region’s leading economies.

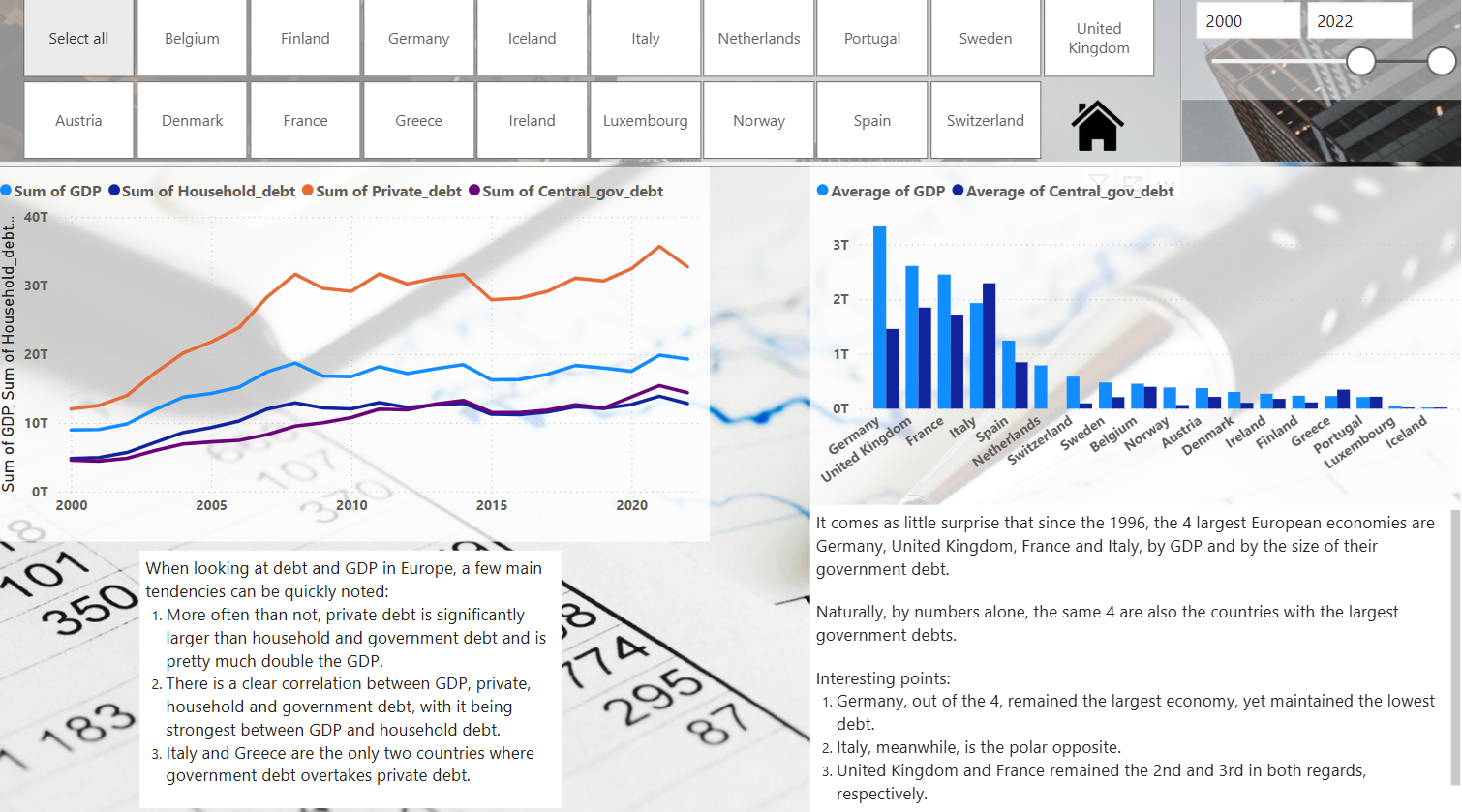

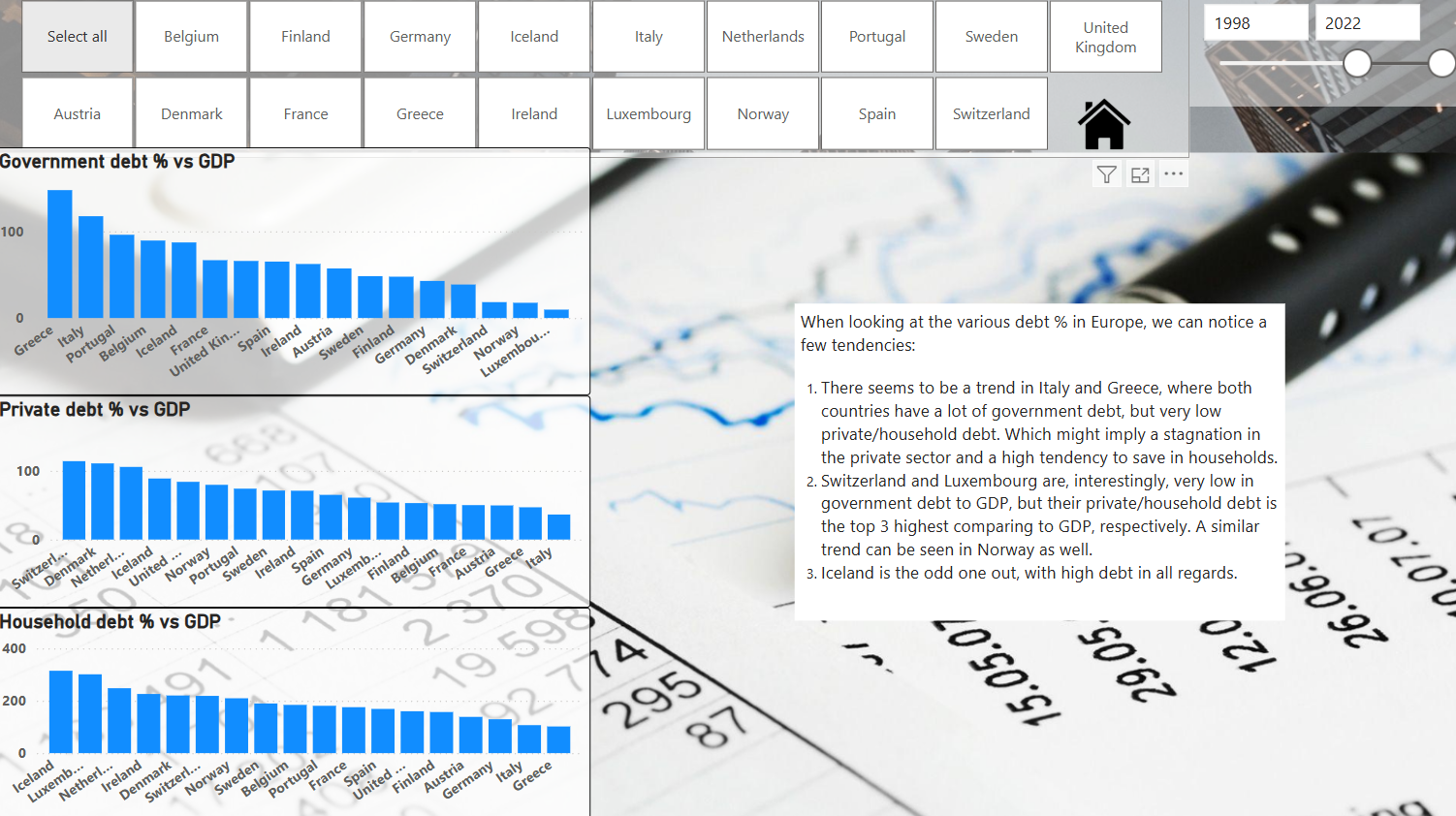

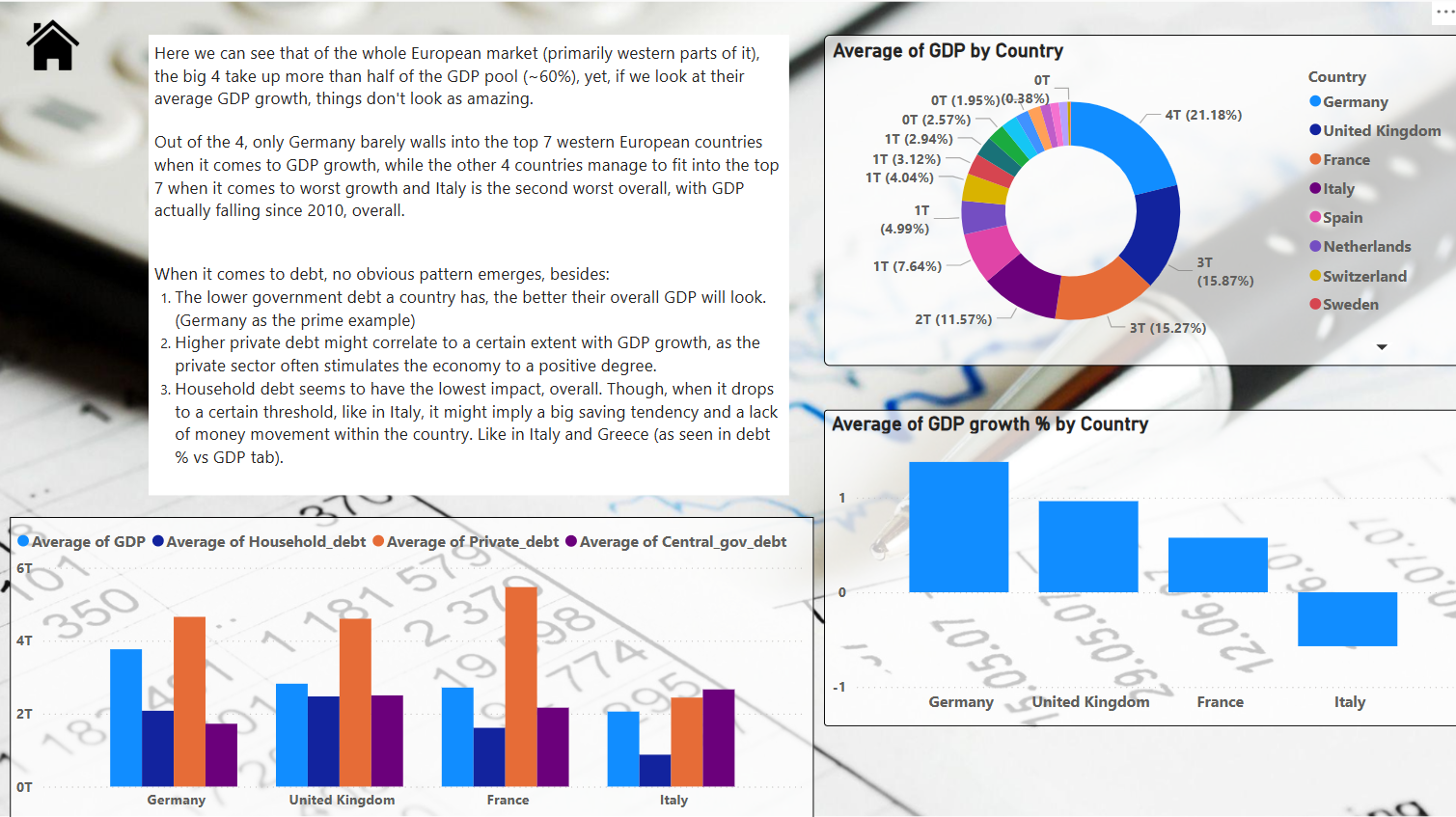

The analysis confirms that the four largest Western European economies by GDP are Germany, the United Kingdom, France, and Italy. A general correlation exists between overall debt and GDP trends, with government debt showing the strongest link. However, private debt appears less correlated, and its relationship with government debt remains inconclusive. While private debt is generally high across the region, struggling economies like Italy and Greece exhibit lower levels.

High government debt often correlates with lower GDP growth, as seen in Italy and Greece, which have both high debt-to-GDP ratios and weak growth. Conversely, countries like Norway, Luxembourg, and Switzerland, which maintain low government debt, show relatively strong GDP growth—though not always the highest. This suggests that while low debt can support growth, it does not guarantee it.

Importantly, being a large economy does not equate to strong growth. Among the top four economies, only Germany ranks among the top seven in GDP growth, while Italy lags significantly.

In conclusion, while there are observable patterns—particularly between government debt and economic performance—debt alone does not fully explain GDP growth. Private and household debt can sometimes support economic expansion, and more comprehensive data is needed to draw definitive conclusions.